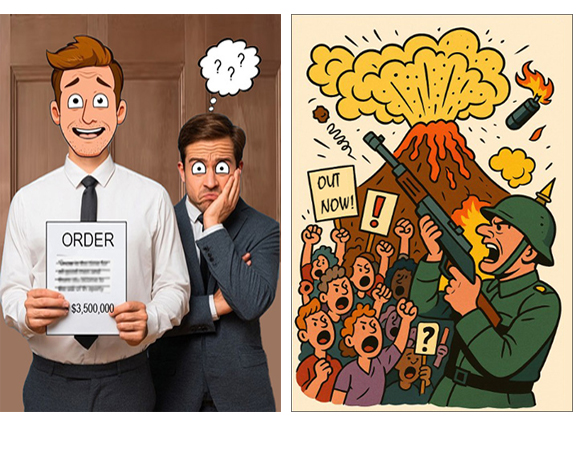

Letters of credit are used for the following reasons:

- To protect against buyer risk. If the buyer is of unknown creditworthiness, then the seller has the security of the bank’s payment undertaking.

-

To protect agains country risk.

The buyer may be willing and able to pay; but economic or political conditions in the buyer’s country may prevent or delay payment.

This is a real concern when dealing with less developed countries and/or countries with foreign exchange shortages. To protect against these risks, a confirmed letter of credit will be necessary – a bank in the seller’s country will (for a fee) add its own payment undertaking to that of the Issuing bank.